BTC Price Prediction: Long-Term Bullish Outlook Amidst Short-Term Consolidation

#BTC

- Technical indicators show Bitcoin consolidating near key support levels with mixed momentum signals

- Institutional adoption continues to accelerate with major corporate treasury allocations and expanding Bitcoin strategies

- Long-term price projections remain bullish driven by scarcity, adoption growth, and evolving regulatory landscape

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Support

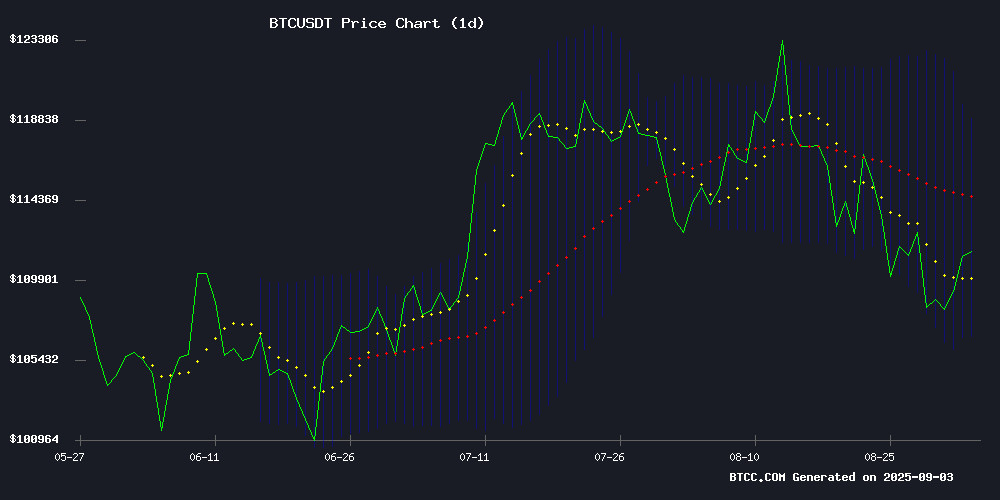

According to BTCC financial analyst Emma, Bitcoin is currently trading at $111,285, slightly below its 20-day moving average of $112,839. The MACD indicator shows a positive reading of 3589.17, suggesting some bullish momentum remains, though the histogram at 256.26 indicates weakening momentum. Bitcoin is trading within the Bollinger Bands with support at $106,745 and resistance at $118,932. Emma notes that 'the current positioning near the middle band suggests consolidation, with a break above $112,839 needed to confirm renewed bullish momentum.'

Market Sentiment: Institutional Adoption Offsets Short-Term Concerns

BTCC financial analyst Emma comments that 'the news flow presents a mixed but ultimately constructive picture for Bitcoin.' Positive developments include CIMG's $55 million allocation to bitcoin treasury strategy and expanding Bitcoin treasury purchases totaling $450 million. Additionally, Metaplanet's growing 20,000 BTC hoard and Gemini's upcoming $2.3 billion IPO demonstrate continued institutional interest. However, Emma cautions that 'while institutional adoption provides strong long-term support, short-term headwinds remain with only 9% of supply at loss suggesting potential for further correction before recovery.' The rare buy signal indicating potential market bottom aligns with technical analysis suggesting consolidation near current levels.

Factors Influencing BTC's Price

Nasdaq-Listed CIMG Allocates $55M Stock Sale Proceeds to Bitcoin Treasury Strategy

CIMG Inc., a Nasdaq-listed sales development company, has finalized the private placement of 220 million common shares, raising $55 million exclusively for Bitcoin acquisition. The firm has already converted the entire proceeds into 500 BTC, cementing its commitment to cryptocurrency as a core treasury asset.

CEO Wang Jianshuang outlined plans to expand digital asset reserves while exploring synergies with emerging technologies. "Our strategy extends beyond accumulation—we're actively pursuing integrations with AI and layer-2 solutions like Merlin Chain," he stated, signaling a multidimensional approach to crypto adoption.

The transaction was executed under Regulation S, bypassing SEC registration requirements. This move mirrors the corporate Bitcoin strategy pioneered by MicroStrategy, with over 170 companies now maintaining crypto treasuries according to industry estimates.

Strategy Expands Bitcoin Treasury with $450 Million Purchase

Strategy, the largest bitcoin treasury company formerly known as MicroStrategy, has bolstered its BTC holdings with a $450 million purchase. The firm acquired 6,048 Bitcoin between August 26 and September 1, 2025, bringing its total holdings to 636,505 BTC at an average cost of $73,765 per coin.

Michael Saylor, co-founder of Strategy, remains bullish on Bitcoin's long-term potential despite recent price corrections. The firm reported a 25.7% year-to-date yield on its Bitcoin investments and disclosed proceeds from share sales, including preferred stock and common stock offerings.

Bitcoin Flashes Rare Buy Signal Indicating Potential Market Bottom

Bitcoin has triggered a short-term buy signal not seen since its previous swing lows at $49,000 and $74,000, according to on-chain analyst Frank from Vibe Capital Management. The signal, derived from the short-term holder MVRV Bollinger Bands, suggests statistically depressed valuations for newer coins relative to their cost basis. Historical precedents point to this metric marking local exhaustion of selling pressure.

Supporting the bullish case, the STH-SOPR metric—tracking profit-taking by recent buyers—remains below 1.0, indicating short-term holders are realizing losses rather than profits. Derivatives markets show cleaner positioning after seven consecutive days of long liquidations, further reducing speculative excess.

Gemini Targets $2.3 Billion Valuation in Upcoming IPO

Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, is aiming for a valuation of up to $2.22 billion as it prepares for its initial public offering. The exchange plans to offer 16.67 million shares priced between $17 and $19 each, potentially raising $317 million under the ticker symbol "GEMI."

The move reflects a resurgence in crypto-related public offerings in the U.S., following successful debuts by Circle and Bullish. Gemini WOULD become the third publicly traded digital asset exchange, joining Coinbase and Bullish in a market increasingly embraced by mainstream finance.

Analysts attribute the favorable environment to rising cryptocurrency prices and regulatory milestones, such as the approval of spot Bitcoin ETFs. The sector's integration into traditional finance continues to gain momentum, with Gemini's IPO marking another significant step forward.

Bitcoin Correction Could Deepen Before Recovery as Only 9% of Supply at Loss

Bitcoin's current correction appears shallow compared to historical cycles, with only 9% of its supply in the red—carrying unrealized losses of up to 10%. Glassnode data reveals this downturn pales in comparison to the 25% supply loss at the local bottom of this cycle or the 50% supply loss during global bear markets.

The asset dipped to $107,500 this week, marking a 13.4% decline from its August peak of $124,000. While past bull markets saw deeper September corrections—36% in 2017 and 24% in 2021—this cycle benefits from institutional demand via ETFs and corporate treasuries, potentially cushioning further downside.

Entrepreneur Ted Pillows notes the current pullback mirrors historical patterns, suggesting the market may not yet have peaked. The resilience of BTC holders, coupled with structural demand, could limit the depth of this correction.

El Salvador’s Bitcoin Histórico Set for November – A Pivotal Moment for Crypto Adoption

El Salvador is gearing up to host Bitcoin Histórico, the world’s first state-backed Bitcoin conference, on November 12–13 in San Salvador. The event, organized by the National Bitcoin Office (ONBTC), aims to highlight the country’s pioneering role in digital currency adoption since recognizing Bitcoin (BTC) as legal tender in 2021.

The conference will feature prominent voices in the crypto space, including Mexican billionaire Ricardo Salinas and economist Jeff Booth. Framed as a celebration of financial freedom, the event underscores Bitcoin’s dual role as both a financial tool and a symbol of economic sovereignty.

This comes amid growing global momentum for crypto, with BTC surpassing $109,000 and Indonesia joining the push for digital asset adoption. The event could mark a turning point in how nations approach monetary sovereignty in the digital age.

Bitcoin Price Recovery Hopes Rise as Bulls Eye Key Resistance Levels

Bitcoin shows signs of resurgence, climbing above the $110,000 mark with bullish momentum building. The cryptocurrency now faces a critical test at the $112,000 resistance level, a breach of which could signal further upside potential.

Technical indicators reveal a short-term rising channel formation with support at $110,500 on hourly charts. Market participants are closely watching the 76.4% Fib retracement level at $112,000, which represents a key hurdle from the recent swing high of $113,457 to the $107,352 low.

The recovery follows a period of consolidation, with BTC clearing multiple resistance levels including $108,800 and $110,000. Trading volume and price action suggest growing conviction among bulls, though bears remain active NEAR the $111,500 level.

S Korea’s New Top Regulator Faces Scrutiny Over Strategy Shares, Crypto Comments

South Korean lawmakers have intensified scrutiny over Lee Eok-won, the nominee for chairman of the Financial Services Commission (FSC), following revelations of his investments in US stocks, including Bitcoin-adjacent firm Strategy. Lee defended his portfolio as a means to gauge investor sentiment during a National Assembly confirmation hearing.

The FSC, South Korea’s apex financial regulator, holds decisive authority over cryptocurrency policies—a contentious issue as President Lee Jae-myung previously advocated for dismantling the agency. Recent signals suggest a potential reversal or delay of those plans.

Critics highlight the nominee’s holdings in Nvidia and Tesla as contradictory to the administration’s push to revitalize domestic markets. The controversy underscores tensions between personal investment strategies and national economic priorities.

The Shocking Cost Of Bitcoin Payments: One Transaction Can Power a UK Home For 3 Weeks

Bitcoin's environmental impact remains a contentious issue, with its energy consumption under scrutiny. A single Bitcoin transaction consumes more electricity than an average British household uses in three weeks. While renewables contribute to the global hashrate, coal remains a significant factor, complicating claims of sustainability.

Carbon offset initiatives, often touted by Web3 firms, face growing skepticism from scientists. The debate underscores the challenge of quantifying blockchain's true ecological footprint. Proof of Work protocols, exemplified by Bitcoin, face particular criticism for their exponential energy demands compared to other cryptoassets.

Metaplanet Becomes A Global Bitcoin Powerhouse with 20,000 BTC Hoard, More Buys Ahead?

Metaplanet, a Japanese publicly traded company, has emerged as a dominant force in Bitcoin accumulation, amassing 20,000 BTC to secure its position as the sixth-largest corporate holder globally. The firm's recent purchase of 1,009 BTC underscores a strategic pivot from hospitality to digital asset treasury management, surpassing industry players like Riot Platforms.

The MOVE reflects deeper institutional conviction in Bitcoin's role as a hedge against macroeconomic instability. Metaplanet's "21 million plan" directly addresses yen depreciation and inflationary pressures, positioning the company to capture a meaningful share of Bitcoin's finite supply. Crypto influencer Next100XGEMS notes this signals a fundamental realignment of corporate strategy rather than mere financial speculation.

Analysts Raise IREN Price Targets as Bitcoin Miner Pivots to AI Infrastructure

Iris Energy (IREN) shares have surged nearly 400% from April lows as analysts significantly increase price targets following the Bitcoin miner's strategic pivot toward AI infrastructure development. Canaccord Genuity raised its target to $37 from $23, while H.C. Wainwright and Roth Capital set targets at $36 and $35 respectively - representing potential upside of 33-40% from current levels.

The rally stems from IREN's unique positioning to leverage its Bitcoin mining infrastructure for AI data centers. This trend isn't isolated - Terewulf's $3.2 billion deal with Alphabet underscores the lucrative potential of Bitcoin miners transitioning into AI infrastructure providers. The company's August earnings report confirmed the viability of this dual-focused strategy.

While IREN briefly approached $30 before pulling back, the consensus among analysts suggests new all-time highs are imminent. The stock's dramatic recovery from early-year lows reflects growing institutional confidence in crypto miners diversifying into high-growth tech sectors.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, BTCC financial analyst Emma provides the following long-term projections for Bitcoin:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $120,000 - $150,000 | ETF approvals, institutional adoption acceleration |

| 2030 | $250,000 - $400,000 | Global regulatory clarity, mainstream financial integration |

| 2035 | $500,000 - $800,000 | Scarcity value premium, hedge against fiat devaluation |

| 2040 | $1,000,000+ | Network effect maturity, store of value dominance |

Emma emphasizes that 'these projections assume continued adoption growth and favorable regulatory developments, with short-term volatility expected along the upward trajectory.'